Enterprise

Development Support

The FDC provides products and services to SMMEs and Co-operatives in the form of financial support (business loans) as well as business development support (facilitating training and mentoring service providers). The provincial loan products offered to Free State Entrepreneurs by the FDC are:

- Start-up loans for recently established businesses that are mainly at formative stages.

- Expansion loans offering viable to expand

- Business take-over finance to assist potential clients to acquire a business as going concern

- Bridging finance for SMMEs with short-term cash-flow problems with contracts or tenders

What do we need

Loan Application Requirements

- Certificate of incorporation and detailed business plan.

- Premises – Proof of ownership or proforma lease agreement.

- Recent valuation of assets – fixed and movable, not older than 12 months.

- Resolution from board of directors/ members appointing a member(s) to sign on behalf of the legal entity.

- Proof of residence (FICA).

- Quotations for the movable and immovable assets to be purchased.

- Personal statement of assets and liabilities of the members/ directors.

- Profile and names of board members and management committee.

- For existing businesses submit audited financial statements, for a period of 3 years and six months bank statements.

- Personal Particulars i.e. I.D

- Copies of tax compliance status (SARS) and copy of business trading licence, where applicable.

Qualification Criteria

- Applicants should meet all relevant and applicable statutory requirements;

- Funding shall be considered for acquisition of productive business assets, working capital and buildings;

- Financing of Vehicles/Automobiles for private use is explicitly excluded;

- Financing of debt is explicitly excluded;

- All applicants must be solvent and have the necessary contractual capacity as required by relevant laws and insurance requirements;

- Incorporated bodies must comply with all the relevant legislation;

- The SMME will have its principal place of business and operations within the province and entities with branches operating within the province will be considered for funding assistance only with respect to local operations;

- Equity contribution is NOT required on any FDC loans

- For the Franchise Development Fund only established franchisors with good track record will be considered

What do we fund

Youth

The fund aims to bridge the cash flow needs of SMME's who have to meet specific contracts or orders, specifically those in the service, manufacturing and retail industries.

Franchises

The fund aims to actively promote franchise businesses in the Free State by targeting entrepreneurs from previously disadvantaged groups, with the view of promoting Broad Based Black Economic Empowerment.

Informal Sector

The fund aims to alleviate unemployment through micro-enterprise initiatives and financing of businesses that are in the formation stages. Targeting the informal sector and small start ups

Bridging

Finance

The fund aims to bridge the cashflow of SMMEs who have to meet specific contracts or orders by providing finance to contractors who have been awarded construction tenders or are in the service, manufacturing and retail business (non construction)

Co-operatives

The fund aims to fund co-operatives for expansion and sustainability, through acquisition and supply of any product produced by the co-operatives.

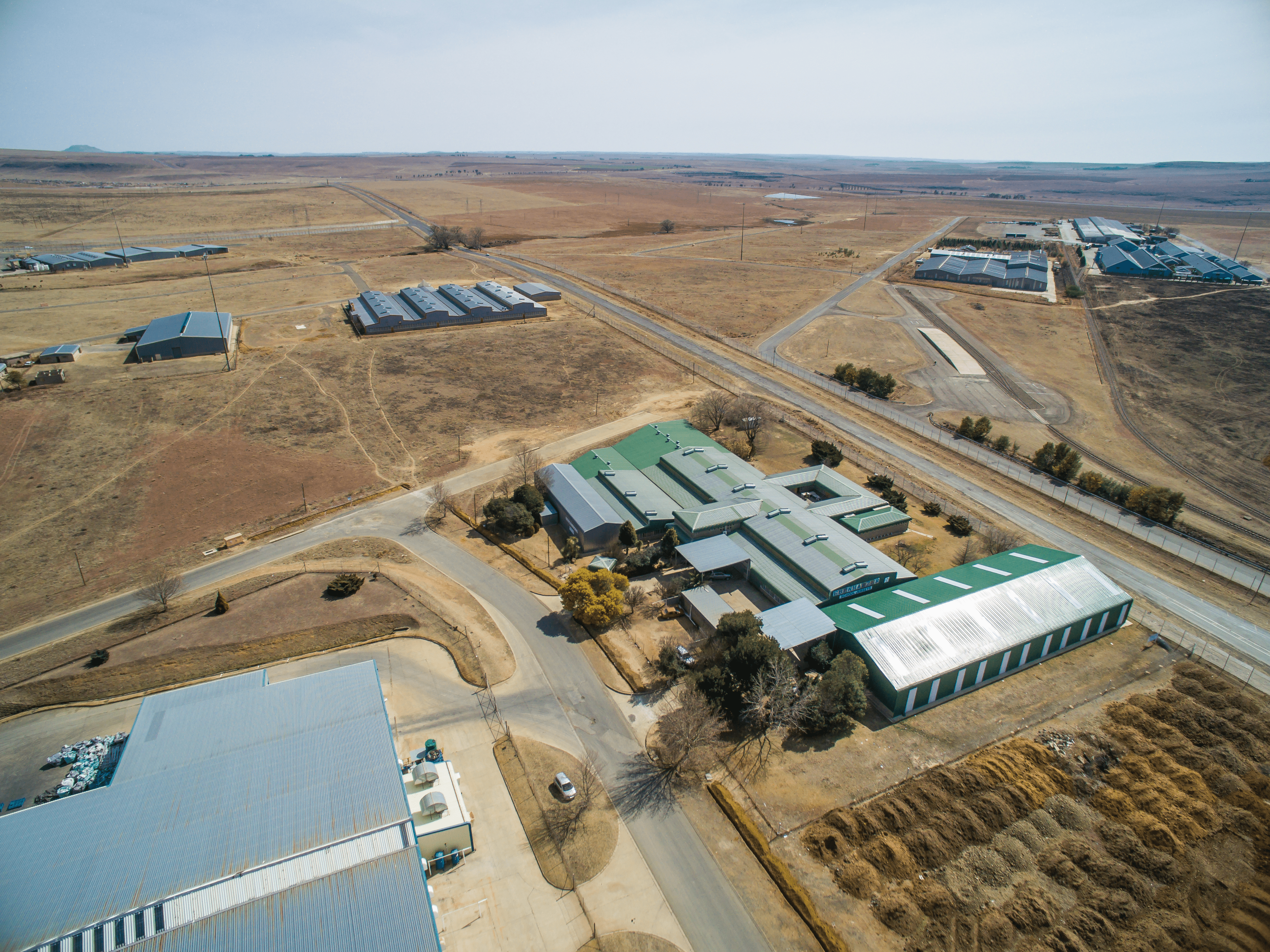

General Enterprise

The fund aims to increase participation of previously disadvantaged individuals in areas of the economy in which they are underrepresented, for example through development of Agro-processing industry and establishment of a significant manufacturing sector in the Free State Province

Sectors

Who do we fund

- Franchising

- Tourism Development

- Business Process Services and Offshoring

- Retail

- Information and Communications Technology

- Agro-Processing

- Chemical Beneficiation

- Mineral Beneficiation

Documents

CONTACT USNOWTO REPORT A CRIME

-

: 0800 701 701 | : [email protected] | : 33490